Understanding Printed Circuit Board HS Code for Smooth Customs Clearance

Navigating international trade can be tricky, especially when it comes to shipping printed circuit boards (PCBs). One of the most crucial steps for smooth customs clearance is using the correct HS code — the global system that classifies products for tariffs and regulations. In this guide, we’ll explain what the printed circuit board HS code is, how to find the right one for your shipment, and why correct classification can save you time, money, and compliance headaches.

Introduction to Printed Circuit Board HS Code

What is an HS Code?

An HS code (Harmonized System code) is a globally recognized numerical classification used to identify goods in international trade. The system is maintained by the World Customs Organization (WCO) and applies to nearly every product shipped across borders.

Each HS code is made up of six digits that describe a product’s category and characteristics. For example, bare printed circuit boards typically fall under HS code 8534.00, which covers “Printed Circuits.”

The main purpose of HS codes is to:

Standardize product classification so customs authorities worldwide can recognize goods consistently.

Determine import duties and tariffs, ensuring that the correct tax rates are applied.

Support trade statistics and compliance, allowing governments to track the movement of goods.

In short, the HS code acts as a universal language for international shipping. Without it, customs clearance would be slower and prone to errors.

Why HS Codes Matter for PCBs

Using the correct HS code for printed circuit boards is crucial for smooth customs clearance. Here’s why:

Direct Impact on Tariffs and Duties

The HS code directly determines how much import tax you will need to pay. For example, in many regions, bare printed circuit boards classified under HS code 8534.00 may qualify for zero import duty, which can significantly reduce overall costs. In contrast, assembled boards with components can fall under different HS headings and may be subject to a duty rate of 2–5%, increasing the total landed cost of the shipment.

Compliance and Legal Requirements

Customs authorities rely on HS codes to verify whether shipments comply with regulations such as RoHS requirements or country-specific safety and quality standards. If a product is misclassified, it can trigger additional inspections or re-evaluations, which may delay the release of goods and slow down the overall delivery process.

Risks of Using the Wrong Code

Delays: Your shipment may be held at the port for reclassification.

Penalties: Authorities can impose fines for incorrect declarations.

Higher Costs: Using a code with a higher duty rate than necessary can raise your landed cost unnecessarily.

For example, if a company ships an assembled control board but declares it under the bare PCB HS code, customs may seize the goods, reclassify them, and bill the importer for extra duties — plus a penalty for noncompliance.

Correct HS code usage not only avoids these risks but also builds trust with customs authorities, reducing the chance of future inspections.

The Correct HS Code for Printed Circuit Boards

Common HS Codes for PCBs

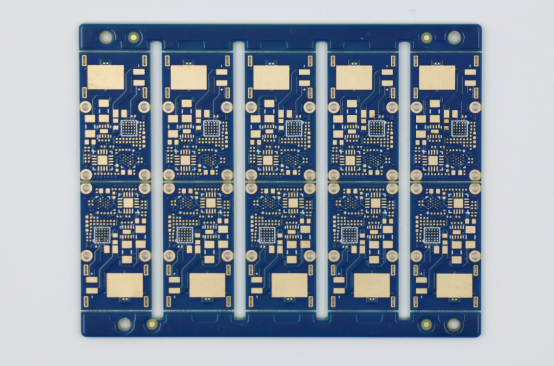

Printed circuit boards are classified differently depending on whether they are bare or assembled with components.

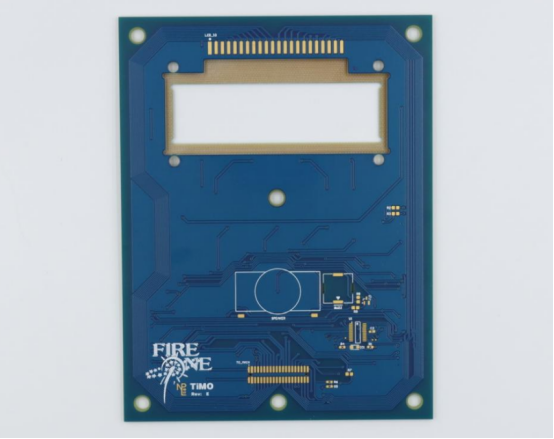

Bare Printed Circuit Boards (PCB)

Bare printed circuit boards typically fall under HS code 8534.00, which is classified as “Printed Circuits.” This category covers all types of PCBs without components, including single-layer, multi-layer, rigid, and flexible boards.

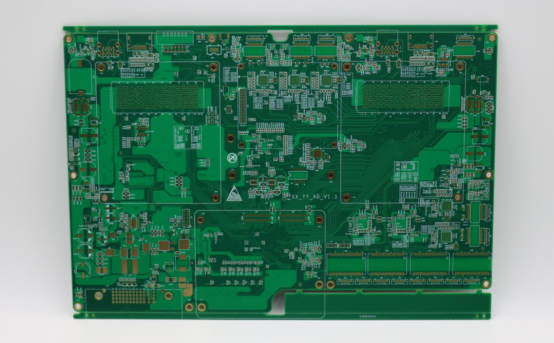

Populated or Assembled PCBs (PCBA)

Assembled or populated PCBs should not be classified under HS code 8534.00. Instead, they are classified based on the function of the assembled board — often under HS heading 85.37, which covers “Boards, panels, consoles… equipped with two or more apparatus for electric control,” or under the HS code that corresponds to the final device they are part of, such as communication equipment or power supply modules.

Prototype Boards or Sample PCBs

Prototype PCBs are usually still classified under HS code 8534.00 if they are bare boards. However, assembled prototype boards must follow the same classification rules as production assemblies, meaning their HS code depends on the board’s function rather than its prototype status.

Key takeaway:

Use HS code 8534.00 for bare PCBs only. If the board has components soldered on, check the functional classification or consult customs.

Regional Variations

While the six-digit HS code is standardized worldwide, many countries add extra digits for more detailed classification.

United States: Uses HTSUS 8534.00.00 for bare PCBs.

European Union: Uses TARIC 8534.00.00.

China: Uses HS 8534.00.00.00 for printed circuits.

India: Also follows HS 8534.00 but may apply specific duty rates.

Because duty rates and sub-classifications can change periodically — with the World Customs Organization updating HS codes every five years — it is considered best practice to regularly check official customs databases, such as the U.S. ITC HTS, EU TARIC, or China Customs HS database.

Additionally, if your shipment involves high-value or unusual PCB types, it is advisable to confirm the correct classification with a licensed customs broker to ensure compliance and avoid potential delays or penalties.

Example Classification Scenario

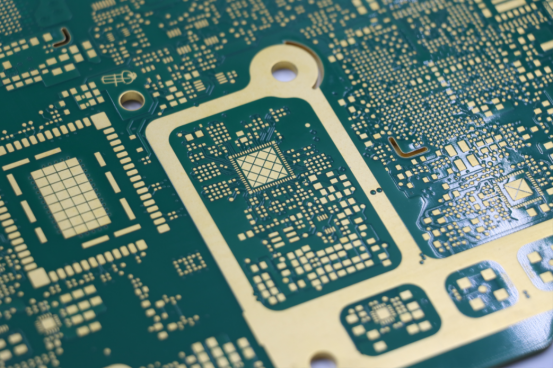

Scenario 1: Bare, 4-Layer FR4 PCB

Step 1: Identify product type → bare board, no components.

Step 2: Match to HS code → 8534.00 – Printed Circuits.

Step 3: Duty rate → may be 0% in many countries.

Result: Classified as “Printed Circuits (bare PCBs)” with minimal duty.

Scenario 2: Fully Assembled Control Board with ICs

Step 1: Identify product type → assembled board with microcontrollers, capacitors, relays.

Step 2: Determine its primary function → control panel for industrial equipment.

Step 3: Match to HS heading → 8537.10 – Boards, panels, consoles for control/distribution of electricity (if applicable).

Step 4: Confirm with customs broker for exact subheading.

Result: Classified under an HS code for assembled control equipment, subject to different tariff rates than bare PCBs.

This step-by-step comparison shows why correct classification is essential: using the wrong code could lead to overpaying tariffs or having goods held at customs for reclassification.

How to Determine the Right HS Code for Your Shipment

Step-by-Step HS Code Lookup Process

Determining the correct HS code for your printed circuit board shipment involves a clear, step-by-step approach to avoid errors and ensure smooth customs clearance.

1. Identify the Product Type

The first step in determining the correct HS code is to identify whether your PCB is bare or assembled/populated with electronic components.

For example, a 4-layer FR4 board with no components is considered a bare PCB, while a control board that includes ICs, resistors, or other electronic parts is classified as an assembled PCB.

2. Check the Harmonized Tariff Schedule Online

To find the relevant HS heading, use official databases such as the World Customs Organization (WCO), U.S. ITC HTS, or EU TARIC.

The process is straightforward: enter keywords like “printed circuit board” or “assembled PCB” into the search tool to locate candidate HS codes that match your product.

3. Match Product Description to Heading/Subheading

Next, compare your PCB’s specifications—such as whether it is bare or assembled, its function, number of layers, and materials—with the descriptions provided for each HS code.

For example, bare PCBs typically correspond to HS code 8534.00, whereas assembled control boards may fall under HS code 8537.10 or the HS code associated with the final device in which the board is used.

4. Confirm with Customs Broker or Local Authority

For high-value, unusual, or prototype PCBs, it is advisable to consult a licensed customs broker or your local customs office.

This step helps ensure that your HS code classification is accurate and compliant, reducing the risk of penalties, shipment delays, or other customs-related issues.

Tools and Resources

Several tools and official resources can help you determine the correct HS code efficiently:

Official Government Websites

WCO HS Database for global reference.

HTSUS (U.S. Harmonized Tariff Schedule) for U.S. imports.

TARIC (EU) for European Union imports.

Trade Portals and Customs Brokers

Many international trade portals offer tools for HS code lookup and tariff calculation, making it easier to identify the correct classification for your shipment. Additionally, licensed customs brokers can validate these classifications and provide expert guidance on compliance, helping to prevent errors and avoid delays at customs.

Using these tools ensures accurate HS code selection and minimizes the risk of customs issues.

Common Mistakes to Avoid

Even small errors in HS code selection can cause delays, penalties, or extra costs. The most common mistakes include:

Misclassifying Assembled Boards as Bare Boards

Assembled PCBs have different duties and regulations.

Using Outdated HS Codes

HS codes are updated periodically; using old codes can result in incorrect duty calculation.

Assuming HS Codes Are Identical Worldwide

While the six-digit WCO code is standardized, countries may use additional digits for sub-classifications and duty rates.

Key takeaway: Accurate HS code classification requires understanding your PCB type, using official resources, and confirming with experts when needed.

Impact of HS Code on Customs Clearance

Tariffs and Duties

The HS code assigned to a printed circuit board directly affects the import duties and tariffs applied by customs authorities. Different classifications can result in significantly different tax rates.

For example, in some regions, bare PCBs under HS code 8534.00 may qualify for a 0% import duty, reducing the overall landed cost. In contrast, assembled PCBs or populated boards may fall under different HS headings, which could carry a duty of 2–5% or higher depending on the country. Proper HS code selection ensures that importers pay only the applicable tariffs and avoid overpayment.

Delays and Penalties

Using the wrong HS code can lead to shipment delays and financial penalties.

Example, a shipment of assembled control boards was declared under the bare PCB code 8534.00. Customs flagged the misclassification, held the shipment for inspection, and required reclassification before release. This resulted in a week-long delay and additional administrative costs.

Misclassification can also incur fines, which vary by country, potentially amounting to thousands of dollars for large shipments.

Ensuring the correct HS code is critical to maintain smooth logistics and avoid unnecessary costs.

Documentation Best Practices

Maintaining accurate documentation is essential for compliance and fast customs clearance:

Include HS codes on all relevant documents

Invoices, packing lists, and shipping labels should clearly display the assigned HS code.

Maintain consistent classification across shipments

Using the same HS code for similar PCB types prevents confusion and minimizes the risk of repeated inspections.

By following these practices, importers and exporters can streamline customs processes, reduce delays, and ensure compliance with international trade regulations.

Best Practices for PCB Importers and Exporters

Work with Experts

Partnering with experienced professionals is essential for accurate HS code classification and smooth customs clearance. Freight forwarders coordinate shipment logistics, ensuring timely delivery, while customs brokers specialize in verifying HS codes, managing documentation, and advising on duty rates and compliance requirements. Leveraging their expertise reduces the risk of misclassification, shipment delays, and penalties.

Keep HS Code Records Updated

HS codes are periodically revised by the World Customs Organization (WCO), typically every five years. Importers and exporters should review and update their PCB classifications regularly to reflect these changes. Maintaining up-to-date HS code records ensures correct duty calculation, compliance with international trade regulations, and consistent reporting across shipments.

Train Your Logistics Team

Internal training is a critical step for long-term compliance:

Establish Standard Operating Procedures (SOPs) for product classification, ensuring all shipments follow consistent rules.

Provide ongoing compliance training so logistics staff stay informed about HS code updates, country-specific regulations, and common pitfalls in PCB classification.

A well-trained team minimizes errors, speeds up customs clearance, and helps maintain a reliable import/export process for your PCB shipments.

Conclusion

Using the correct HS code is essential for smooth customs clearance of printed circuit boards. Accurate classification ensures that shipments are processed efficiently, appropriate duties are applied, and penalties or delays are avoided.

Before every shipment, double-check the HS code against official databases and, if necessary, consult a licensed customs broker to confirm compliance.

If you have further questions or want to learn more about PCBs, PCBMASTER, a professional PCB supplier, is ready to provide guidance and support for all your PCB needs.

FAQs

1. What HS code should I use for a prototype PCB sample?

Prototype PCBs that are bare (without components) are usually classified under HS code 8534.00, the same as production bare boards. If the prototype is assembled with electronic components, the HS code should reflect the board’s function or the final device it is part of, rather than treating it as a bare board. Always check with a licensed customs broker if the prototype is unusual or high-value to avoid misclassification.

2. Are HS codes for PCBs the same worldwide?

The six-digit WCO HS code system is standardized internationally, so the main classification (e.g., 8534.00 for bare PCBs) is consistent. However, many countries add additional digits for more detailed sub-classifications and specific duty rates. For example:

United States: HTSUS 8534.00.00

European Union: TARIC 8534.00.00

China: HS 8534.00.00.00

Because of these variations, always verify the complete HS code and duty rate for the specific country of import.

3. How do I check if my HS code is up to date?

HS codes are updated periodically, typically every five years by the World Customs Organization (WCO). To ensure your PCB classification is current, regularly check official government databases such as the WCO HS Database, U.S. ITC HTS, EU TARIC, and China Customs HS database.

Additionally, if your shipment involves complex, high-value, or unusual PCB types, it is recommended to confirm the classification with a licensed customs broker to ensure compliance and avoid potential delays or penalties.

Regular updates prevent errors, unnecessary tariffs, and potential customs penalties.

4. Can I ship PCBs without providing an HS code?

No. Most countries require an HS code on invoices, packing lists, and shipping documents for customs clearance. Omitting the HS code can result in:

Shipment delays due to customs inspections.

Fines or penalties for noncompliance.

Higher risk of misclassification or incorrect duty application.

Including the correct HS code ensures smooth customs processing and reduces logistical risks.

5. What happens if my HS code is incorrect?

Using the wrong HS code can have several consequences:

Delays: Customs may hold your shipment for inspection or reclassification.

Penalties: Financial fines vary by country and can be significant for high-value shipments.

Overpaid Duties: Incorrect codes may result in paying higher tariffs than necessary.

Example: An assembled control board declared as a bare PCB (8534.00) may be held at customs, require reclassification, and incur both fines and additional administrative fees. Correct HS code selection avoids these risks and ensures regulatory compliance.