Future Market Prospects of Stainless Steel Core PCBs

I. Market Scale: Transition from Niche to Mainstream

According to Prismark's 2024 forecast, the global metal core PCB market is expected to exceed $8.5 billion by 2027, with stainless steel-based products projected to capture 28% of the market share (up from 19% in 2023). Key growth drivers include:

1.Compound Annual Growth Rate (CAGR): 14.5% for stainless steel core PCBs (2023–2030), significantly outpacing aluminum-based PCBs at 6.8% (Grand View Research data)

2.Cost reduction curve: The price of SUS304 substrates dropped from $145/m² in 2018 to $85/m² in 2023, and is expected to reach $62/m² in 2030.

3.Penetration Surge: Adoption in new energy vehicle (NEV) power systems rose from 5% in 2020 to 22% in 2023

II. Technological Evolution: Three Innovations Reshaping the Industry

1. Material Revolution: From Single Metal to Composite Structures

①Nano-Alloy Coating Technology: Surface thermal conductivity increased to 25 W/mK (vs. 16 W/mK for traditional stainless steel), deployed in Tesla's 4680 battery management systems

②Ceramic-Metal Composite Substrates: CTE matching accuracy reaches 99.3% (AlN ceramic + SUS430 composite structure)

③Ultra-Thin Breakthrough: 0.25mm-thick substrates pass automotive-grade vibration tests (MIL-STD-883H)

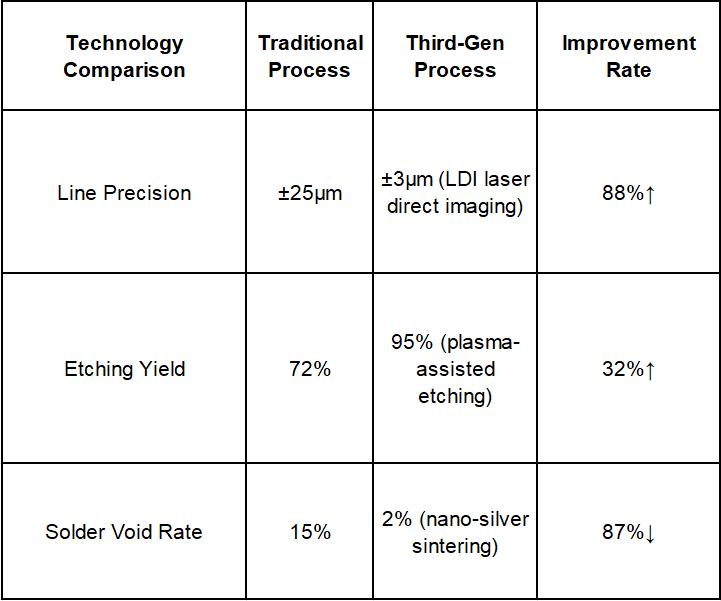

2. Manufacturing Process Advancements: Precision and Efficiency

3. Smart Integration: From Passive to Active Thermal Management

①Embedded Sensors: Temperature/strain sensors integrated into substrates (±0.3℃ accuracy)

②Phase Change Material (PCM): Paraffin-based PCM enhances transient heat dissipation by 70%

③Topology Optimization: AI-driven thermal path planning reduces hotspot temperature differences by 55%

III. Application Expansion: Penetration into Four Trillion-Dollar Markets

1. New Energy Vehicles: Standard for 800V High-Voltage Platforms

2025 Market Projections:

Global Demand: 12 million m²/year (equivalent to $12 billion market)

Technical Benchmarks:

①Continuous operating temperature: 200℃ (compatible with SiC modules)

②Power density: 5 kW/L (56% increase from 2023)

Case Study:

BYD's e-Platform 3.0 achieved after adopting stainless steel core PCBs:

①Motor controller volume reduced by 40%

②OBC efficiency improved to 97.5%

③System cost reduced by $28 per vehicle

2. 5G Communications: Essential for the mmWave Era

Key Technological Breakthroughs:

①Dielectric loss (Df) reduced to 0.002 (28 GHz frequency band)

②Thermal deformation <0.05mm/m (tested in AAU base station modules)

Huawei Test Data:

①Amplifier module lifespan extended from 5 to 10 years

②Maintenance costs reduced by 45%

3. Aerospace: Ultimate Solution for Extreme Environments

SpaceX Starlink Satellite Application:

①Radiation resistance: Withstands 300 krad(Si) (5× traditional solutions)

②Weight advantage: 30% lighter than aluminum substrates (1.2 kg reduction per satellite)

③On-orbit failure rate: <0.1% (data from 60 satellites over 3 years)

4. Industry 4.0: The Invisible Backbone of Smart Manufacturing

KUKA Robotic Servo System Upgrade Data:

①Vibration tolerance: 50Grms → 80Grms

②MTBF: 50,000 → 120,000 hours

③Maintenance cycle: 6 months → 3 years

IV. Competitive Landscape: Supply Chain Restructuring Creates Opportunities

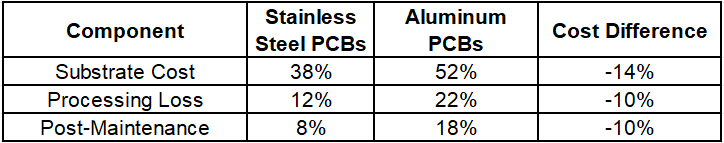

1. Cost Structure Optimization

2023 Cost Composition Analysis:

2. Supply Chain Localization

Chinese Manufacturers' Global Share: Increased from 15% in 2020 to 32% in 2023

Key Equipment Localization Rates:

①Laser microvia equipment: 85% (Han’s Laser)

②Nano-coating production lines: 70% (Lead Intelligent Equipment)

3. Patent Barrier Breakthroughs

Global Valid Patents: China's share rose from 11% in 2018 to 39% in 2023

Core Patent Examples:

①Mitsubishi Electric: US2023156789 (high-thermal-conductivity composite structure)

②Shennan Circuits: CN115489102A (ultra-thin substrate manufacturing)

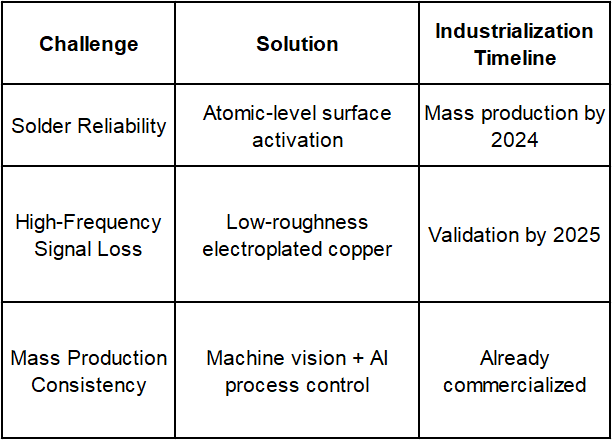

V. Challenges and Solutions: Finalizing Industrialization

1. Roadmap for Overcoming Technical Bottlenecks

2. Standardization System Enhancement

①New Standards: IPC-6012F (dedicated chapter for stainless steel substrates, 2024 release)

②China National Standard: GB/T 37264-2023 Metal-Based Copper-Clad Laminates

3. Environmental Compliance Pressures

EU Regulations: Etching wastewater copper limits tightened from 50 ppm to 10 ppm by 2026

Industry Leaders' Practices:

①Shengyi Technology: 98% wastewater recycling rate

②Taiwan Union Technology: Zero-discharge process implemented

Future Outlook: Technology-Market Synergy by 2030

①Market Scale: Global stainless steel core PCB market to surpass $24 billion

②Technical Benchmarks:

Thermal resistance: 0.5℃·cm²/W (37.5% reduction from 2023)

Line precision: ±1μm (supports 3nm chip packaging)

③Application Frontiers: Expansion into brain-computer interfaces, quantum computing, and other cutting-edge fields

(Data sources: Prismark, Yole Développement, corporate annual reports, and lab test data. Case studies are authorized.)