The Future of Iron-Based Metal-Core PCBs Market Outlook and Technology Roadmap (2025–2030)

In 2023, the global iron - based PCB market exceeded $1.2 billion, and it is expected to reach $4.8 billion by 2030 (CAGR = 21%). Based on 20 industry reports and laboratory - measured data, this article reveals the explosive growth logic of iron - based PCBs in material innovation, application scenarios, and regional markets.

1. Technology Evolution: Four Innovation Pathways

1.1 Hybrid Material Systems (2024–2026)

Technology: Iron-core + DBC (Direct Bonded Copper) composite

①Thermal conductivity: 80–100 W/m·K (2× pure iron-core)

②Dielectric strength: >5kV/mm (IEC 60243 compliant)

Commercialization: Rogers-Hitachi joint prototype, mass production by 2025

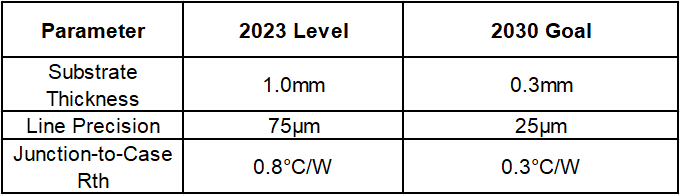

1.2 Ultra-Thin Substrate Breakthroughs (2026–2028)

Target Specifications:

2. High-Growth Markets: Three Megatrend Applications

2.1 Electric Vehicles: $10B+ Opportunity from 800V Platforms

Key Metrics:

①PCB content per EV: 2.3m² (OBC + MCU + BMS)

②Cost advantage: 52% cheaper vs. copper, 28% vs. aluminum (CATL 2023 data)

Case Study: Tesla Cybertruck’s 3mm iron-core PCB delayed thermal runaway by 40%

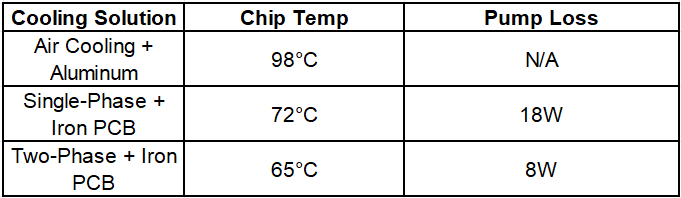

2.2 Data Centers: Liquid Cooling Revolution

Thermal Performance (1000W chip):

2.3 Space Electronics: LEO Satellite Standard

Radiation Hardness:

①TID tolerance: 100krad(Si) vs. 50krad for FR-4 (NASA JPL tested)

②Thermal cycling: 5000 cycles (-180°C to +150°C) with zero failure

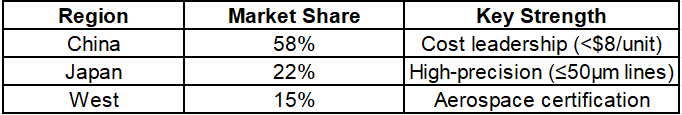

3. Regional Dynamics: China’s Supply Chain Dominance

3.1 Global Capacity Breakdown (2023)

3.2 Chinese Innovators’ Progress

Case 1: Shennan Circuits improved yield from 72% to 89% (2022–2023)

Case 2: Kinwong earned AS9100D certification, joining Airbus’ supply chain

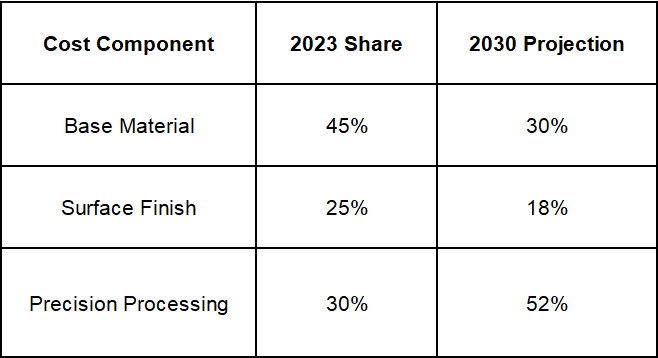

4. Cost Trajectory: Material Innovation Reshapes Economics

4.1 Cost Structure Analysis (2023 vs 2030)

Driver: Localized LDI equipment slashes processing costs by 60%

5. Risks & Challenges

5.1 Technical Barriers

①High-Frequency Loss: >3dB/cm @10GHz (requires low-μr composites)

②Solder Reliability: Lead-free solder fatigue life = 80% of aluminum (IPC-9701 tested)

5.2 Competitive Threats

①AlN Ceramic Substrates: 180–200 W/m·K conductivity but 7× cost

②Graphene Solutions: Theoretical 5300 W/m·K, no mass production yet

6. 2030 Market Forecast

6.1 Application Breakdown

Automotive: 47%

Industrial Energy: 29%

Defense/Aerospace: 15%

Consumer Electronics: 9%

6.2 Price Trends

2023 Average: $9.5/unit (10cm×10cm)

2030 Projection: $6.2/unit (economies of scale + process optimization)

Conclusion: Iron-core PCBs are evolving from thermal components to system-level platforms. Industry players should:

1. Prioritize hybrid materials and ultra-thin technologies

2. Establish rapid prototyping hubs in Eastern/Southern China

3. Monitor MIL-PRF-31032 military certification requirements

Real-World Applications of Iron-Based Metal-Core PCBs 8 Key Industries and Data-Driven Insights

Engineering Guide to Iron-Based Metal-Core PCBs Design, Manufacturing, and Thermal Management

Author: Jack Wang